As part of its recent budget testimonies provided to the Legislature, NJBIA has released its updated 2022 Regional Business Climate Analysis showing New Jersey continues to significantly trail the rest of the region in business climate.

The analysis shows New Jersey is maintaining the highest corporate business tax rate, state sales tax rate and property tax paid as a percentage of personal income, as well as the second highest top income tax rate, in the region.

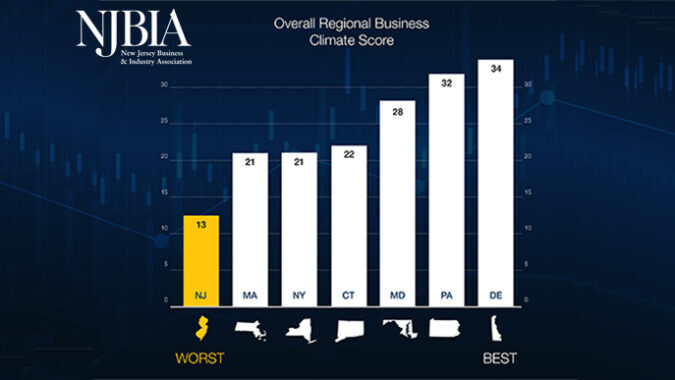

NJBIA analyzed six individual business cost drivers in seven states and, using a scoring system of those metrics, determined New Jersey ranks at the bottom overall behind Massachusetts, Connecticut, New York, Pennsylvania, Maryland and Delaware.

The two-page graphic can be found here.

“As we go through the budget season, it’s important that our policymakers understand how much of a regional and national outlier New Jersey is in terms of taxes and the cost of doing business,” said NJBIA President & CEO Michele Siekerka.

“We all know and appreciate the current attention paid toward affordability. But for businesses – particularly our smaller businesses that faced the longest shutdowns and restrictions in the nation during the pandemic and are also facing $1 billion in unemployment tax increases over three years – there is still a long way to go to bring them affordability.

“For the sake of our competitiveness and the health of our businesses, we should all be looking at this data and asking why New Jersey must be such an outlier with our taxes and seeking comprehensive solutions and reforms during the budget season to improve our business climate.”

NJBIA’s annual Regional Business Climate Analysis, prepared by Director of Economic Policy Research Kyle Sullender, observes six factors that affect business competitiveness — minimum wage, top income tax rate, top corporate tax rate, state sales tax rate, property taxes as a percentage of income and the national unemployment insurance tax ranking — to see how New Jersey compares with six states in the region.

Each state’s rates in each category are scored from 1 (least competitive) to 7 (most competitive).

New Jersey’s overall business climate score (13) was the weakest for the fourth straight year. Delaware (34), Pennsylvania (32) and Maryland (28) were ranked first, second and third, respectively. Connecticut (22), New York (21) and Massachusetts (21) rounded out the top six.

Compared to the six other states, New Jersey has the top corporate tax (11.5%), state sales tax (6.63%) and property taxes paid as a percentage of income (4.98%).

New Jersey’s income tax rate of 10.75%, formerly the top rate in the region, has been surpassed by New York’s 10.9% income tax rate.

Massachusetts currently has the top minimum wage rate of $14 per hour. However, Connecticut’s current $13 rate will increase to $14 in July, while New Jersey is also slated to increase to $14 per hour on Jan 1, 2023.

Another metric in the analysis observes the Tax Foundation’s National Unemployment Insurance Tax Ranking, which accounts for the UI tax rate, taxable wage base and other factors. Massachusetts is ranked 50th in the nation in this category, while Delaware is ranked third best nationally. New Jersey is ranked 32nd overall in this category.

New Jersey’s top corporate tax rate of 11.5% is actually the highest rate in the nation. In 2018, New Jersey’s corporate tax rate went from 9% to 11.5% in what was termed a “temporary increase.” It was originally scheduled to phase down to 10.5% in 2020 and back to 9% in 2021.

Instead, the 2.5 percentage point surcharge was extended by the Legislature in 2020 until the end of 2023.

“New Jersey’s top corporate tax rate of 11.5% is probably the most glaring,” Sullender said. “It’s the only double-digit state corporate tax rate in the nation.

“Now we hear of Pennsylvania looking to greatly reduce its 9.99% corporate tax rate, which is second worst in the region. If that happens, and New Jersey maintains its current corporate tax rate, our state will be even more of an outlier in the region – and that does not help our overall competitiveness,” Sullender said.

“Out of the proposed $48.9 billion budget for FY23, only 0.1% will go toward relief for small businesses that are leasing new space or adding capital costs,” Siekerka added. “There really is no tax relief of any kind for businesses in the budget or part of the ANCHOR Property Tax relief program.

“When seeing the cost of doing business here in New Jersey, and another $1 billion in UI tax increases over three years, we hope our policymakers understand they could be and should be doing much more to help our businesses.”