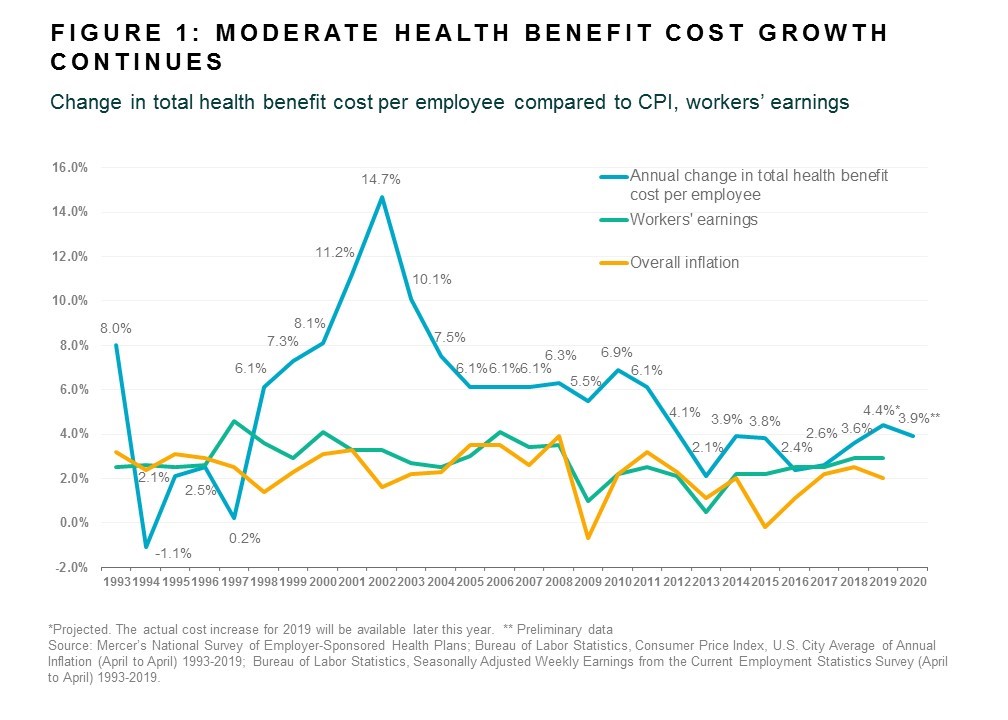

Health benefit costs will grow by nearly 4% in 2020, according to early results from the latest Mercer National Survey of Employer-Sponsored Health Plans. Based on responses from 1,511 US employers1, Mercer projects that the average total health benefits cost per employee will rise by 3.9% in 2020 (see Figure 1).

“While this continues the trend of low single-digit increases that began in 2012, health benefit costs are still rising faster than overall inflation. And with the economy slowing, employers know they can’t afford to be complacent,” said Tracy Watts, Mercer’s National Leader for US Health Policy.

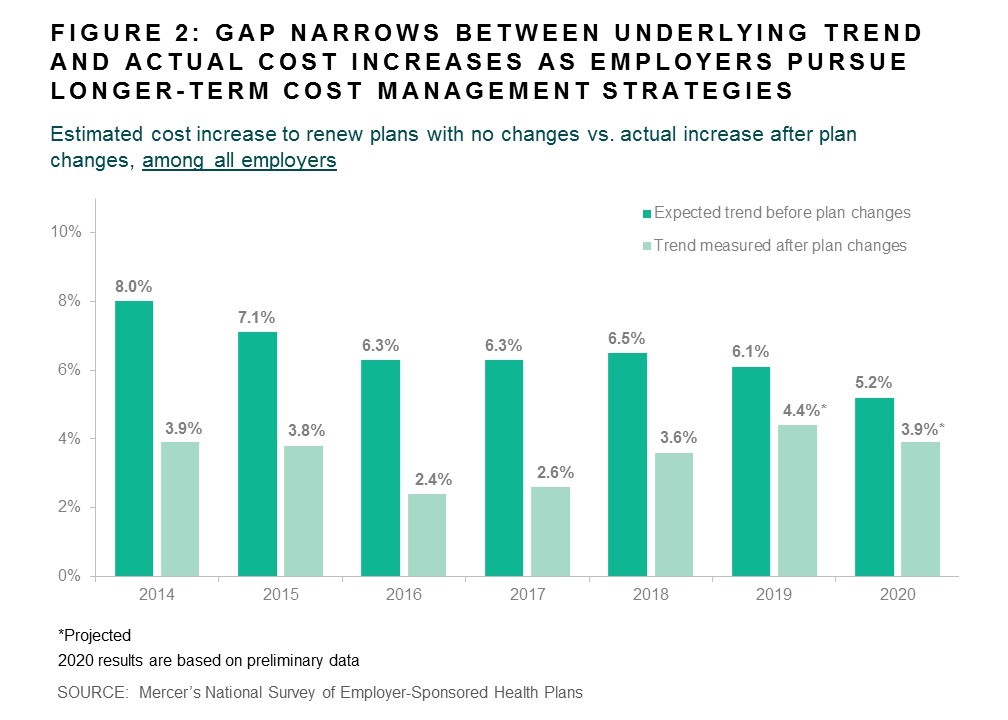

Early indicators are that cost-shifting to employees will be less of a factor than in recent years, with just 43% of responding employers raising deductibles or otherwise cutting benefits to hold down cost in 2020. Since 2014, the underlying medical trend — the amount costs would rise if employers renewed plans without making changes — has cooled from 8% to 5%, easing some of the pressure to make short-term cost cuts (Figure 2). During this time, employers have been adopting tactics that seek to reduce cost via improved health outcomes, such as targeted support for specific health conditions and steering plan members to higher-quality providers.

Related: NJBIA 2018 Health Benefits Survey Results

“Rather than shift cost to employees, these approaches typically enhance the health care experience,” commented Ms. Watts.

In support of higher quality care, employers continue to add tech-enabled programs designed to help members with specific health issues such as diabetes, insomnia, and infertility. In 2019, 62% of respondents with 500 or more employees offer one or more of such targeted solutions, compared to 55% in 2018. A program for diabetes, for example, can significantly improve quality of life while reducing high-cost trips to the emergency room.

Improving access to health benefits information and resources is another growing trend. In 2019, 40% of respondents with 500 or more employees say that all or most of their benefit offerings are accessible to employees on a single, fully integrated digital platform – most often through a smartphone app – compared with 34% in Mercer’s 2018 survey.

Survey results also show employers taking action to help ensure plan members receive high-quality care. For example, 39% of employers with 500 or more employees now provide access to a Center of Excellence (COE) for cardiology, bariatric surgery, cancer and other complex treatments. Further, 16% say they steer employees to the COE with lower cost-sharing or even by requiring its use.

“Employers have been experimenting with new approaches to tackle high costs, inconsistent quality, and low patient satisfaction,” said Ms. Watts. “While there’s still so much more to do, it’s encouraging to see signs that health innovation may be starting to slow health cost growth – without shifting cost back to employees.”

1The complete survey results based on responses from more than 2,500 employers with 10 or more employees will be released later this year, and will look at the full range of strategies employers are using to manage cost.