If you missed NJBIA’s seminar earlier today about better healthcare options for small businesses during the open enrollment period, you can still watch the event recording to learn about new money-saving plan options outlined by officials at Association Member Trust.

Open enrollment, the annual period when people can enroll in health insurance or make coverage changes, began Nov. 1, and runs through Jan. 15 for 2023 healthcare plans.

“It is time to evaluate your health plan to see what type of options you have, what you need and what might be available to you,” said Harvey Mishkin, AMT’s chief operating officer, who spoke during NJBIA’s online seminar Wednesday.

AMT, a nonprofit multi-association benefits trust, leverages the power of its members – 17 independent trade associations and 2,200 participating employers – to offer self-funded plan options that tend to be more flexible and less expensive than traditional insurance plans. Because it is a nonprofit, AMT even pays dividends back to its members once it has paid claims, expenses and funded future reserves.

“Over the past 10 years we’ve paid back in the neighborhood of $18 million to our members,” Mishkin said. “We give money back whenever we can … that’s something you generally won’t find anywhere else.”

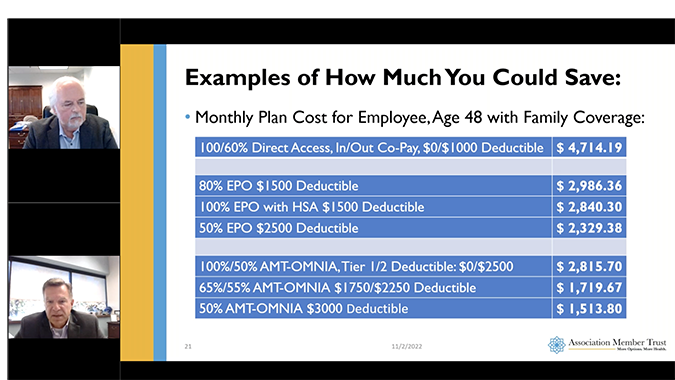

AMT offers more than 200 plan options through its network partner, Horizon Blue Cross Blue Shield, to give employers as many cost-saving options as possible, said Michael Leneghan, AMT’s sales director.

“We have options available on what I would call every delivery system,” Leneghan said. “We have direct access plans and PPO plans; those plans will let you go in and out of network. We also have EPO plans and OMNIA plans, those are network-only plans.”

Healthcare benefit costs are increasing everywhere because the number of claims is up, as more people are utilizing elective surgeries and healthcare services that they had been put off during the first two years of the pandemic, Mishkin said.

Businesses looking to save money should know that in many cases, employers are spending money for more expensive out-of-network plans, when their employees are overwhelmingly utilizing in-network providers, Mishkin pointed out.

“When we look at our claims, 95% of our claims that come in are through network providers,” Mishkin said. “So, in many instances, our employers are spending money for a benefit that many times they and their employees never even use. It’s kind of like a ‘what if?’ scenario and that can be really costly.”

During the online seminar, Mishkin and Leneghan discussed some of the newer plan options that deliver better value and balance in-network coverage with the out-of-network safety net. They provided specific examples of savings from their case studies.

To watch the recorded presentation, go here.