The IRS said this week it will be sending letters to investors who provided inadequate documentation on forms used to certify that a corporation or partnership is a qualified fund set up to invest in an Opportunity Zone.

Opportunity Zones, established under the Tax Cuts and Jobs Act of 2017, offer capital gains tax incentives for investments in more than 8,700 designated census tracts across the country. New Jersey has 169 Opportunity Zones spanning 75 municipalities in 21 counties.

Opportunity Zones were created as an economic development tool that allows people to invest in distressed areas. The purpose is to spur economic growth and job creation in low-income communities while providing tax benefits to investors.

However, an audit released by the Treasury Inspector General for Tax Administration (TIGTA) in February found the IRS had not established appropriate processes and procedures to identify inaccuracies and inconsistencies in the information reported.

TIGTA’s report said a closer examination is warranted of 341 funds nationwide that had reported investments in other funds or themselves during the 2019 tax year, as well as 5,141 investors. The IRS agreed with six of TIGTA’s recommendations at that time and said it would issue notices to noncompliant Opportunity Zone funds and investors.

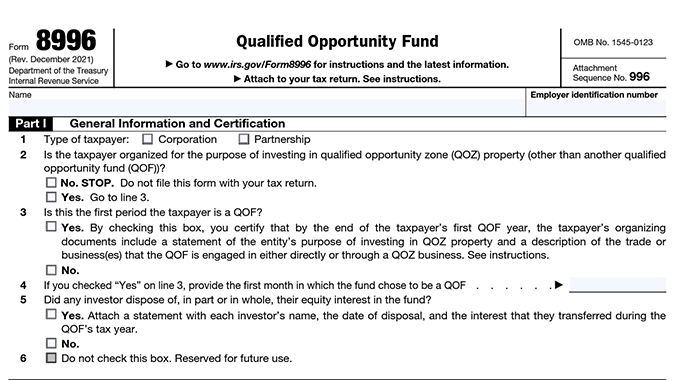

The IRS announced on Tuesday it will be warning taxpayers who provided inadequate information on Form 8996 Qualified Opportunity Fund (QOF) that they will be receiving letters this month requiring them to take additional action, including filing an amended return or an administrative adjustment request if they intend to maintain their certification as a QOF.

Regarding investor reporting, taxpayers who did not properly follow instructions on Form 8997 Initial and Annual Statement of Qualified Opportunity Fund Investments, will also be receiving letters if information is missing, invalid, or does not meet requirements for maintaining their investment in a QOF.

If these taxpayers intend to maintain a qualifying investment in a QOF, they can file an amended return or an administrative adjustment request with a properly completed Form 8997 attached. Failure to act will mean those who received the letter may not have a qualifying investment in a QOF and the IRS may refer their tax accounts for examination. This may result in owing taxes, interest, and penalties on gains improperly deferred.