—Overview—

In some instances employers may need to close their workplaces due to weather conditions or other circumstances. This document provides New Jersey-specific information on when workers must be paid during emergency closures; best practices for adopting emergency closing policies; and information about when employees may be eligible for unemployment.

—Background—

In some cases workers in New Jersey may need to be paid during unexpected office closings. Generally speaking, the determining factor is a worker’s status as exempt (not eligible for overtime) versus non-exempt (eligible for overtime) under the federal Fair Labor Standards Act (29 U.S.C. 201, et seq.) and the New Jersey Wage and Hour Law (N.J.S.A. 34:11-56a et seq.). It is important that employers understand their obligations to pay when work is closed since not paying workers correctly could result in financial penalties and jeopardize overtime exemptions.

— Emergency Closings and Exempt (Non-Overtime) Employees —

Can exempt (not eligible for overtime) employees be docked pay if the workplace is closed?

If an employer has a leave program and a business shuts down for less than a full business week due to an emergency, the salaries of exempt (not eligible for overtime) workers usually can’t be docked. However, exempt workers can be required to use some form of paid time off like vacation or personal time as long as it has been accrued.

In the event that workers have no time banked, they still must be paid. Since employers are required to pay exempt workers regardless of whether they have time banked or not, many just adopt an across-the-board a policy of forgiving the exempt employee absences during emergency closures without requiring that paid time off be used.

The other alternative many employers in office settings adopt is to require exempt workers to telecommute and work remotely if it is unsafe for them to physically report to work.

What happens if the workplace is open during bad weather, but an exempt employee does not report?

If the business remains open during inclement weather and an exempt (not eligible for overtime) worker does not report for “personal” reasons, they can be docked a full-day’s pay provided they didn’t work any portion of the day (in-person or remotely). Many attorneys will advise their clients that if the employee worked at least part of the day (even answering a few emails), they generally have to be paid for that full week. This includes if the office closes early/opens late. Docking pay for partial-day absences could compromise the worker’s overtime exemption.

Since the rules for exempt employees are very complex, the vast majority of employers will instead require the employee to use vacation or other paid time off rather than dock pay. If a worker has no paid time off available, many employers will advance time and try to recoup it later in the year.

— Emergency Closings and Non-Exempt (Overtime Eligible) Employees —

Can non-exempt (eligible for overtime) employees be docked pay if the workplace is closed?

Generally employers only have to pay non-exempt employees for the hours they actually work. In the event of an early closing/late opening, the employee need only be compensated for the time they put it. Similarly, if a workplace is closed, and the employee does no work, they usually don’t need to be paid.

However, there are some limited exceptions. For instance, if a non-exempt worker reports to work only to find that the workplace is closed, New Jersey law requires that they be paid for at least one hour at their regular rate. Additionally, if a non-exempt employee works remotely by checking email, phone messages, (whether they were directed to do so or not), they must be paid for that time.

Although employers may not have a legal obligation to pay non-exempt workers during emergency closings, many will still do so as an added benefit. One way that some employers accomplish this is to build “snow days” into their calendars so that they can budget to pay non-exempt employees even if the office is closed.

If an employee works 40 hours and gets 8 hours of pay while a workplace is closed in the same week, does the employer have to pay overtime for the hours over 40?

No, not unless the employee worked (in-person or remotely) over 40 hours in the workweek. Overtime must be paid at a rate of time and one-half times the employee’s regular rate of pay for each hour actually worked in excess of 40 hours.

To that point, if an employer doesn’t pay non-exempt workers during an emergency closure and then offers more hours at a later date to make up for the lost wages, any time worked over 40 hours within a 7-day period must be considered overtime.

What happens if the workplace is open during bad weather, but a non-exempt employee does not report?

Generally speaking, employers only have to pay non-exempt employees for the time they actually work. So if an employee does not report to work and the employer is certain that the employee has completed no work, they do not need to be paid.

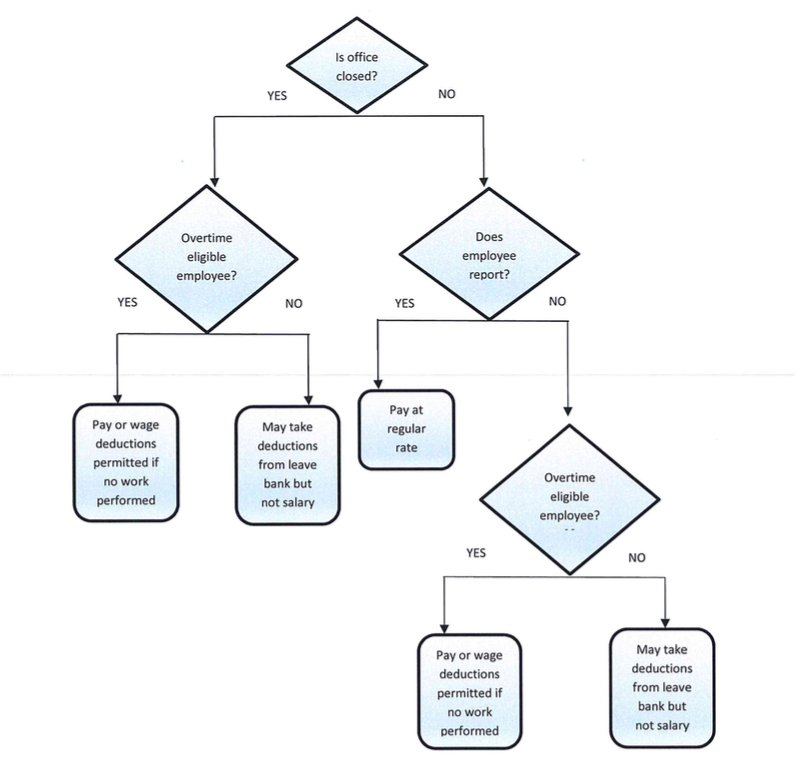

The chart below summarizes pay practices for exempt and non-exempt employees during emergency closures, assuming an employer offers some form of paid time off.

—Best Practices for Managing Office Closures—

Can employers discipline workers for not reporting if the workplace remains open in inclement weather?

While the desire to continue business as usual is understandable, instituting a discipline policy for inclement weather absences can create a situation where workers feel compelled to report to work even when they feel it is unsafe. No employer wants his or her employee getting into an accident on the way to work. Most experts advise employers to put worker safety first.

Is it a good idea to base workplace closings on whether a state of emergency has been declared?

Typically not. In New Jersey a state of emergency is a designation used by the Governor to supplement local resources and seek federal assistance when a significant (often weather-related) event is expected or has already happened. Although many people associate a state of emergency with an automatic travel ban, this is not the case. Travel restrictions may not be imposed at all, or, can be limited to a specific area of the state.

Additionally, a state of emergency may be declared in advance of an event which may or may not materialize. If an employer decides in advance to shut down based on a state of emergency and it turns out that the expected inclement weather does not materialize, it can be difficult to call workers back in as they may react negatively.

What are the hallmarks of a good inclement weather/emergency closing policy?

While certainly not exhaustive, the questions below attempt to provide a framework for an inclement weather/emergency closing policy.

- Will any jobs be considered essential during an emergency?

- Who will determine if the workplace will close early, be closed for the entire day, or open late?

- How and when will workers be notified if a decision is made to delay opening or to close for an entire day?

- When inclement weather or an unexpected emergency situation develops during the workday, who will decide if the workplace will close?

- How will the organization address situations where the workplace is open, but an employee decides weather conditions in his/her area are too hazardous to permit travel?

- Will the organization make concessions for workers who request to work from home or bring children with them to the workplace?

- Will workers with remote access be expected to conduct some or all of their job responsibilities at home while the workplace is closed?

- Will workers be expected to be on-call while the workplace is closed?

- Will all employees be paid for the full day when the workplace is closed, or, will full pay only be granted to exempt employees? Will temporary hourly employees and interns be covered under the same policy?

— Unemployment During Workplace Closures—

Can workers claim unemployment for temporary workplace closures for which they are not paid?

Yes. Although a five day standard may be used to determine a permanent separation from employment in New Jersey, there is no magic set of days an employee has to be out to trigger regular unemployment insurance (UI) eligibility.

So, if a person lost two days of work because of a weather-related event (or received reduced wages), they can file a claim for those two days. In most cases, they will get some type of regular UI, assuming they have met other eligibility requirements. Even if a person returns back to work, their claim can still be processed for the time lost.

Employers should be aware that their tax rates will fluctuate depending upon their “experience” with unemployment insurance claims. Thus, rates will rise as the number of claims filed against an employer’s account increases.

Are business owners eligible for unemployment while a workplace is closed?

Business owners, corporate officers and others with more than a 5 percent interest in a business are not eligible for UI benefits with two exceptions.

The first is if a business owner operates a part-time corporate business while employed full-time. In this instance, the business owner may be able to establish a claim based on the full-time work.

The second is in the event of a major disaster declared by the President of the United States. In this case Disaster Unemployment Assistance (DUA) may provide financial assistance to those whose employment has been lost or interrupted as a direct result of a major disaster, who are not eligible for regular UI, and who did not receive full wages during a disaster. Again, DUA only becomes available following a presidential declaration.

—More Information—

For more information, please contact NJBIA’s Member Action Center at 1-800-499-4419, ext. 3 or member411@njbia.org.

This information should not be construed as constituting specific legal advice. It is intended to provide general information about this subject and general compliance strategies. For specific legal advice, NJBIA strongly recommends members consult with their attorney.